Eer kahein chalo Flipkart ki maare, Bir kahein chalo Flipkart ki maare, Hamao kahein chalo ham’o Flipkart ki maare.

Jokes apart. There have been a flurry of blogs predicting the bubble and how insane the whole valuation of flipkart is. Insane or not, someone with a deep pocket and insights into the company which you and me are not privy to has made the bold decision to invest in Flipkart. That is the only bottomline. The rest that you read in public blogs is mere speculations. Some even appearing to me as sour grapes.

When it comes to the general financial marketing (primary as well as secondary included), I am a big fan of Nicholas Taleb. His rule of thumb is you just cannot predict anything (event the bubble). The market is so volatile and complex that the experts themselves are taking a calculated risk. The market just won’t perform according to your’s or mine prediction. Who are we fooling, when randomness is already here to fool us (shuks bad PJ. sorry Nicholas).

Recent bursts in the bubble, both the dot com and the financial meltdown have provided good insight into the creation and eventual bursts of these bubbles. But on the flip side, now everyone claims that they can now predict these bubbles, and have been predicting since about a year starting with Groupon. Both inside and outside the country. What they fail to understand that the same insight that was provided by earlier meltdowns have made the investors wiser as well. And the collective wisdom of all these ‘smart’ folks is unlikely to create a bubble on the same lines as the last one.

The dotcom bubble was preceded with a flurry of dotcom companies going IPO. Is this the same story today? No. We are not doing the same mistakes as last time, but yes we are making some mistakes. These mistakes may burst the bubble tomorrow, a year later or even 10 year later. NO ONE CAN PREDICT THAT.

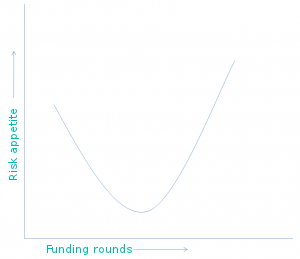

The pattern of risk taking over multiple rounds of funding resembles an inverted bell curve to me.

At the beginning the founders taking the biggest leap of faith in starting their company following their vision and passion. They are the ones taking the biggest risks. Subsequent rounds of funding are taken at a somewhat reduced risk when a company starts to show a good growth and cash flow. Investors look at this growing company and genuinely want to help it grow further. The company then becomes a coffee table discussion amongst everyone and the founders the poster boys. Whoever invested in the company around this time possibly took the lowest risk. The company now is on a meteoric rise. Whoever invests now is taking the biggest risk on betting a sustained meteoric rise. Is it not fair then that the equity that they get for their investment is valued at an insane figure?

The bubble will burst in one year, or 10 year or 20 year later. No one knows. What we can do is, be cautious in our investment and let others manage their own investment. You don’t know their risk profile and are not entitled to comment on it. Period.